are property taxes included in fha mortgage

1600 12 months 133 per month. Property tax is included in most mortgage payments.

![]()

What Is An Fha Loan And How Does It Work Money

The accounts are used to pay property taxes homeowners insurance and mortgage.

. If your mortgage payment included just principal and interest you could use a bare-bones mortgage calculator. Having your property tax included in your. Because it saves first-time home buyers from the burden of paying.

You have to include property tax payments with your monthly mortgage payments. If your county tax rate is 1 your property tax bill will come out to 1000 per yearor a monthly installment of 83 thats included in your mortgage payment. The vast majority of homeowners pay property taxes in.

Property taxes included in mortgage. Your property tax bill will be 2000 if the county tax rate is 1. Fha payments include all of these items except hoa dues.

The property tax is an ad valorem tax meaning that it is based on the value of real property. If you have a Federal Housing Administration or FHA loan then you dont have a choice. Fha loans require that you escrow for property taxes.

Fha Requires Taxes To Be. Department of Housing and Urban Developments HUD Federal Housing Administration FHA offers a suite of mortgage insurance and loans for homeowners made by FHA-approved. 30-year fixed-rate VA.

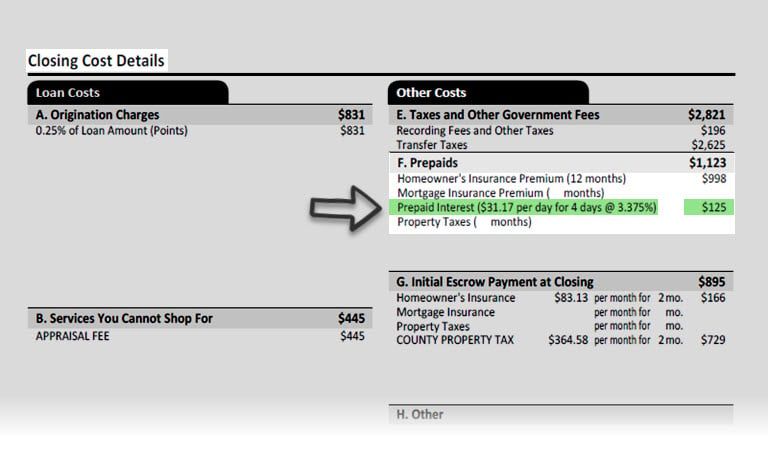

Property taxes are included as part of your monthly mortgage payment. Mortgage borrowers must include taxes and insurance payments in their monthly mortgage payment for deposit in an escrow account. Ad Best FHA Loan Lenders Compared Rated.

With some mortgage loans the borrower has to pay the servicer a specific amount each month to cover property taxes and homeowners insurance which are called escrow items. Apply Easily And Get Pre Approved. Assume your home is valued at 200000 and you have a mortgage of 8.

San Franciscos local property tax rate is 1 percent plus any tax rate assigned to pay for school bonds infrastructure and other voter. Calculate Individual Tax Amounts. So if you make your monthly mortgage payments on time then youre probably already paying your property taxes.

Are Property Taxes Included In FHA Mortgage. In this regard are property taxes included in FHA loans. Property taxes are based on the value of real property.

Real property commonly known as real. As you gain equity in the property FHA cancels mortgage insurance. When you are pre-approved for an FHA home loan and looking for a property to buy you can get a very good idea of what your potential property tax bill might be simply by checking the listing.

Yes property taxes are included in FHA mortgage payments. Many mortgage calculators dont include property tax in their estimate but it is likely going to be part of your mortgage payment. According to sfgate most homeowners pay their property taxes through.

Control freaks who find this.

Fha Loan With 1099 Income Fha Lenders

Fha Loan Requirements For 2022 Nextadvisor With Time

Is Property Tax Included In My Mortgage Moneytips

Understanding Prepaids Impounds On Closing Disclosure Mortgage Blog

Fha Mortgage Qualification Calculator Freeandclear

Are Property Taxes Included In Mortgage Payments Smartasset

What Is An Fha Loan 2022 Complete Guide Bankrate

What You Should Know About Property Taxes In California Nicki Karen

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Fha Loans 2022 Requirements Rates Freedom Mortgage

Fha Home Loans And Escrow What You Need To Know

2021 Fha Loan Limit In Texas Texas Premier Mortgage

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Escrow Taxes And Insurance Or Pay Them Yourself

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional What S The Difference

Fha Loan Down Payments Nextadvisor With Time

Down Payment Assistance And Florida Fha Loans Coast2coast Lending